santa clara county property tax rate

When are Secured Property Taxes due in Santa Clara County. Santa Clara County comprises San Jose and Silicon Valley making it one of the wealthiest counties in America.

What You Should Know About Santa Clara County Transfer Tax

However you have until 5 pm.

. This calculator can only provide you with a rough estimate of your tax liabilities based on the. Whether you are already a resident or just considering moving to Santa Clara County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Find the property you are interested in then click the link under the column heading APN Suffix.

Learn more about SCC DTAC Property Tax Payment App. FY2019-20 PDF 198 MB. Property taxes are levied on land improvements and business personal property.

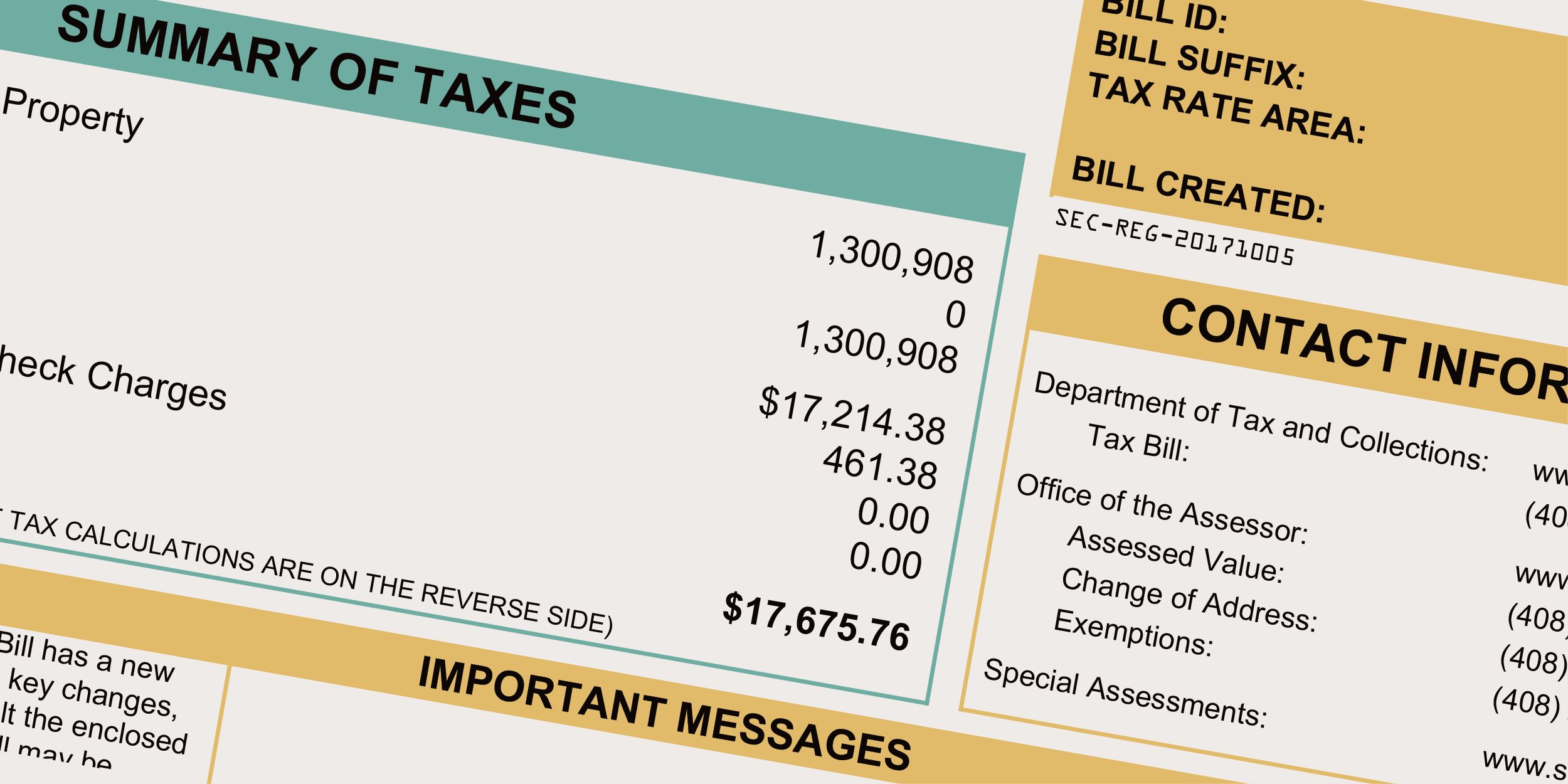

PROPERTY ASSESSMENT INFORMATION SYSTEM. The first installment is due and payable on November 1. The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County.

The secured property tax bill is payable in two installments. Skip to Main Content Search Search. The median property tax on a 70100000 house is 518740 in California.

Property Taxes--Secured and Unsecured The County cities schools and other local taxing agencies derive a portion of their revenue from property taxes. The property tax for a home in Santa Clara County can be estimated by multiplying the purchase price by 125. Currently you may research and print assessment information for individual parcels free of charge.

Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC a new mobile app launched by the County of Santa Clara Department of Tax and Collections to provide more than 500000 property owners with convenient access to pay their secured property tax payments. Santa Clara County Property Taxes. Enter Property Parcel Number APN.

Property Taxes - CAFR Statistical Section. The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County. But because the median home value in Santa Clara County is incredibly high at 829600 the median annual property tax payment in the county is 6183 the second highest in California behind Marin County.

Property taxes are levied on land improvements and personal property under legal authority from California Codes. The total sales tax rate in any given location can be broken down into state county city and special district rates. Tax rates can be complicated even without a lack of transparency so it is easier to look at the tax rate as a percentage of property value.

Tax Rate Book Archive. The property must be located in Santa Clara County. It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt.

Information about Property Assessments can be accessed on the PANIS page of the Santa Clara County Assessor. They can be contacted by 408 299-5500 for more information or they can be reached on their website at wwwtmedu. Santa Clara County Property Tax.

Code 27201 The document must be submitted with the proper fees and applicable taxes. The last point is important as Santa Clara Countys government has faced recent criticism for lack of transparency in its tax rate calculations. FY2020-21 PDF 150 MB.

CC 1169 The document must be authorized or required by law to be recorded. The median property tax on a 70100000 house is 469670 in Santa Clara County. Codes 6103 27201 27261 The document must be in compliance with state and local laws.

County of Santa Clara. PROPERTY ASSESSMENT INFORMATION SYSTEM. The median property tax on a 70100000 house is 736050 in the United States.

Learn all about Santa Clara County real estate tax. Santa Clara County Property Tax Rates The average effective property tax rate in Santa Clara County is 075. In Santa Clara Countys case the tax rate equates to 0.

COUNTY OF SANTA CLARA PROPERTY TAXES. With almost 2 million people living within its boundaries its a popular place to stake a claim but like any other place to acquire real property youll want to have an in-depth understanding of the Santa Clara County property taxes. On December 10 to make your payment before a 10 penalty and 2000 cost is added to your bill.

GASB 44 Economic Condition Reporting 10-year data Property TaxValuation related Changes in Net Position Changes in Fund Balances of Governmental Funds General Governmental Tax Revenues by Source Taxable Assessed Value of Property Property Tax Rate. This table shows the total sales tax rates for all cities and towns in. Proposition 13 the property tax limitation initiative was approved by California voters in 1978.

The property tax is 1 but there are typically 025 special assessments added. Property Tax Rate Book Property Tax Rate Book. Currently you may research and print assessment information for individual parcels free of charge.

Home Page Browse Video Tutorial Developers. Compilation of Tax Rates and Information. If December 10 or April 10 falls on a weekend or County of Santa Clara holiday then the Delinquent Date is extended to the next business day.

Pay secured property taxes online prior to midnight pacific time on December 10 and April 10 to avoid penalties. View Property Ownership Information property sales history liens taxes zoningfor 837 Hydrangea CT Sunnyvale CA 94086 - All property data in one place. California has a 6 sales tax and Santa Clara County collects an additional 025 so the minimum sales tax rate in Santa Clara County is 625 not including any city or special district taxes.

Santa Clara County Ca Property Tax Calculator Smartasset

Property Tax Rate Book Controller Treasurer Department County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Ca Property Tax Calculator Smartasset

Special Fund On Santa Clara County Property Tax Bill Pays For Employee Pensions The Mercury News

Santa Clara County On Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019

Santa Clara County Ca Property Tax Calculator Smartasset

Santa Clara County Ca Property Tax Calculator Smartasset

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Ca Property Tax Calculator Smartasset

Understanding California S Property Taxes

Property Tax Distribution Charts Controller Treasurer Department County Of Santa Clara